Navigating the Registration Process for Medicare Benefit Insurance Coverage

As individuals approach the phase of thinking about Medicare Benefit insurance, they are fulfilled with a labyrinth of options and regulations that can in some cases feel frustrating. Allow's check out how to effectively browse the enrollment process for Medicare Benefit insurance.

Eligibility Requirements

To get Medicare Benefit insurance, individuals need to satisfy certain qualification demands laid out by the Centers for Medicare & Medicaid Provider (CMS) Qualification is mostly based upon factors such as age, residency standing, and enrollment in Medicare Component A and Part B. Many individuals aged 65 and older get approved for Medicare Benefit, although certain people under 65 with certifying disabilities might likewise be eligible. In addition, people should reside within the service area of the Medicare Benefit strategy they desire to enroll in.

In addition, individuals need to be signed up in both Medicare Part A and Component B to be qualified for Medicare Benefit. Medicare advantage plans near me. Medicare Benefit plans are called for to cover all solutions given by Original Medicare (Part A and Component B), so enrollment in both parts is required for people seeking protection with a Medicare Benefit strategy

Protection Options

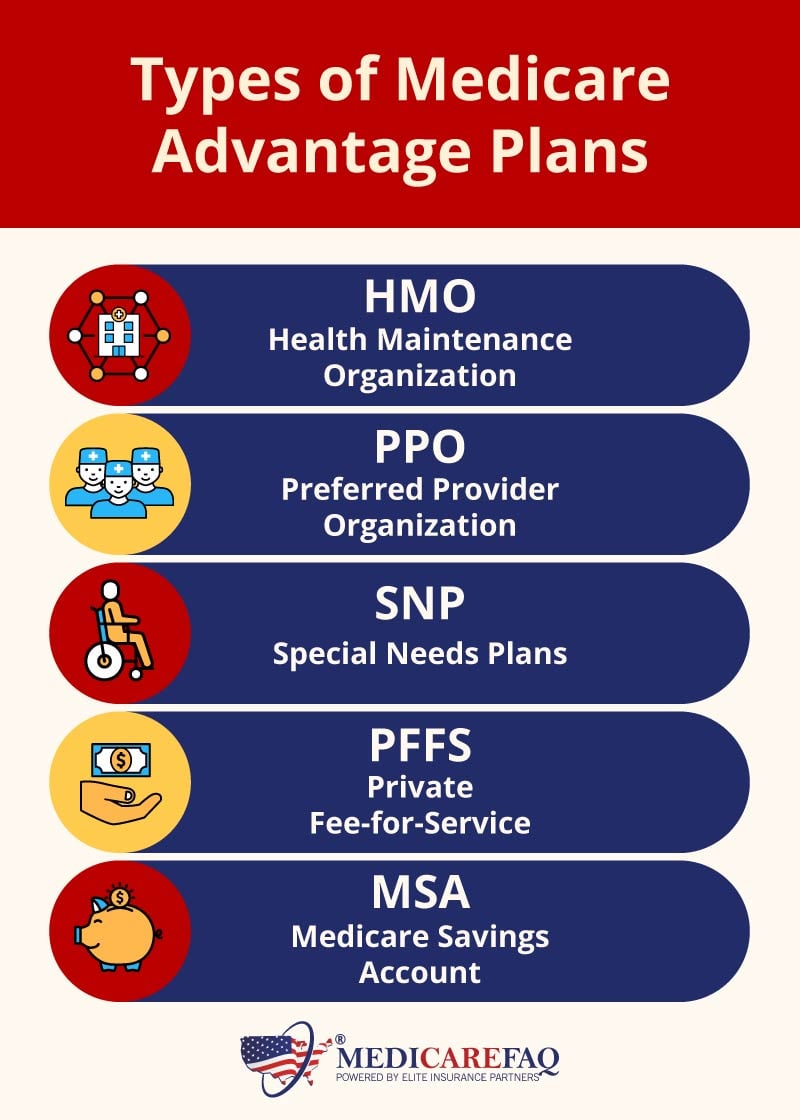

Having actually met the eligibility demands for Medicare Benefit insurance policy, people can currently explore the different insurance coverage choices offered to them within the plan. Medicare Advantage intends, additionally understood as Medicare Component C, use an "all-in-one" option to Original Medicare (Part A and Component B) by offering fringe benefits such as prescription medication protection (Component D), vision, dental, hearing, and health care.

One of the key coverage alternatives to take into consideration within Medicare Advantage prepares is Health and wellness Maintenance Organization (HMO) plans, which normally require individuals to pick a primary treatment medical professional and acquire references to see specialists. Unique Demands Strategies (SNPs) cater to individuals with specific wellness problems or those that are dually qualified for Medicare and Medicaid.

Understanding these insurance coverage choices is crucial for individuals to make enlightened choices based upon their medical care needs and preferences.

Enrollment Durations

Actions for Enrollment

Understanding the enrollment durations for Medicare Advantage insurance policy is vital for beneficiaries to browse the process effectively and properly, which starts with taking the necessary actions for registration. You need to be enrolled in Medicare Part A and Part B to qualify for a Medicare Benefit strategy.

After selecting a strategy, the next step is to register. Medicare advantage plans near me. This can usually be done during details enrollment durations, such as the First Enrollment Period, Annual Enrollment Duration, or Unique Enrollment Duration. You can sign up straight via the insurer using the strategy, via Medicare's site, or by getting in touch with Medicare directly. Be certain to have your Medicare card and personal information all set when enrolling. Finally, evaluate your enrollment confirmation to guarantee all details are exact prior to insurance coverage starts.

Tips for Choice Making

When assessing Medicare Benefit intends, it is vital to meticulously examine your individual health care requirements and economic factors to consider to make an educated decision. To help in this procedure, think about the complying with pointers for choice making:

Contrast Plan Options: Study available Medicare Advantage prepares in your area. Contrast their costs, protection benefits, service provider networks, and high quality ratings to identify which straightens ideal with your demands.

Think About Out-of-Pocket Expenses: Look beyond the regular monthly premium and take get redirected here into consideration factors like deductibles, copayments, and coinsurance. Calculate possible annual costs based on your medical care use to discover one of the most cost-efficient option.

Testimonial Star Ratings: Medicare appoints star rankings to Advantage prepares based on aspects like consumer satisfaction and top quality of care. Picking a highly-rated plan may show much better overall efficiency and service.

Verdict

In verdict, recognizing the eligibility needs, coverage options, enrollment periods, and steps for enlisting in Medicare Benefit insurance coverage is vital for making informed decisions. By browsing the registration procedure efficiently and considering all offered information, individuals can ensure they are picking the very best plan to meet their medical care requires. Making educated decisions throughout navigate here the registration procedure can bring about better health outcomes and monetary security in the long run.